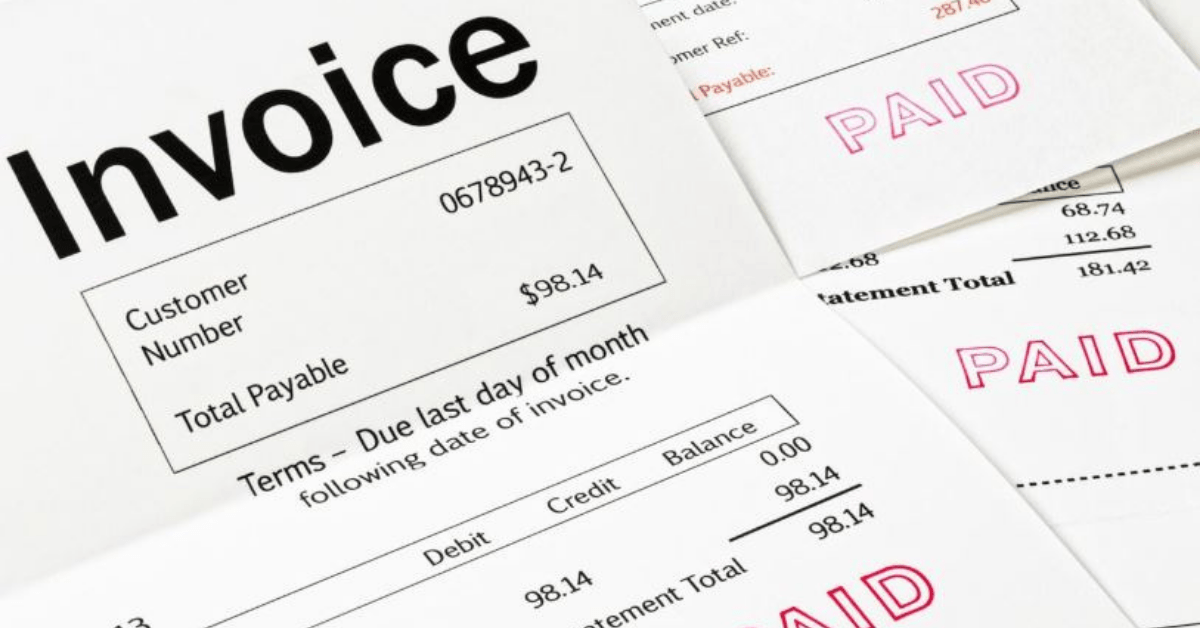

Wire transfer is an electronic medium to send money from one bank account to another. If you are residing abroad and need to send funds to your family or friends in India, you can do so through a wire transfer. This is a secure and safe medium of sending money.

Wire transfer is one of the popular NRI banking services, which works both ways – meaning you can send funds overseas and receive money in your country through this facility. A wire transfer can even be used to transfer funds to pay your home loans or make investments by providing the necessary details. However, note that many banks might charge a fee for the wire transfer facility.

How does wire transfer function?

The wire transfer mode can be used via the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. For instance, suppose you visit a bank in Australia to transfer money to your contact in India. You must provide details about the beneficiary, including their account number, name, and amount to be transferred.

As the amount cannot be transferred directly from one bank to another, wire transfer can help make the fund transfer successful. Once the transfer request is made, the amount is deducted instantly from your savings account and added to the beneficiary’s account.

While the above instance was linked to international transfer, which takes up to five days for the transfer, domestic wire transfer usually takes just one day.

Stepwise measures to initiate a wire transfer

- You will require contacting your bank. Once you do so, you must fill out a request form to initiate the transfer.

- Input the necessary details like the beneficiary’s name, bank, IFSC code, account number, etc.

- State the SWIFT code of your bank and the beneficiary’s bank.

- Submit the filled-up form, after which the required amount will be deducted from your account and transferred to the beneficiary’s NRI.

Benefits and features of a wire transfer facility

A few of the crucial benefits and features of wire transfer include:

- This facility can be used to open an FCNR FD account and make payments for your EMIs, or investments.

- It is a fast mode to transfer money as it takes between 2-5 days for international transfers and one day for domestic.

- The process is convenient as you require issuing an instruction for processing the amount, whether internationally or domestically.

Wire transfer is a medium to move money electronically between two banks. Here in this route, the money goes from one financial institution to another using the SWIFT or Fedwire network. For a swift and hassle-free wire transfer experience, ensure to open an NRI banking or savings account with private banks like IDFC FIRST Bank as they provide better services than public sector banks.

IDFC FIRST Bank offers three types of accounts for NRIs. Each comes with unique benefits that help you save and earn more.